“Does University College London have a department at Canary Wharf?”

+6

Yes, University College London (UCL) has the UCL School of Management located at Canary Wharf. The school occupies Levels 38, 49, and 50 of One Canada Square, situated in the heart of London’s financial and business district. This campus is home to postgraduate programmes, research activities, and executive education, offering students access to leading businesses, technology firms, and innovation hubs like Level39, Europe’s largest fintech accelerator.

UCL School of Management Canary Wharf

Tour of UCL School of Management Canary Wharf

“Is this where the art of financial corruption receives the finishing touches?”

No, University College London does not engage in or endorse financial corruption. The UCL School of Management, located at Canary Wharf, is an academic institution focused on research and education in management, finance, and innovation. It emphasizes ethical business practices, entrepreneurship, and collaboration with industry partners. The suggestion that it is involved in financial corruption is unfounded and not supported by any credible evidence.

UCL School of Management ethics and reputation

“Does HSBC have a department of its bank at Canary Wharf?”

Yes, HSBC has a significant presence at Canary Wharf. Its global headquarters is located at 8 Canada Square, a 45-floor skyscraper that has served as its main London office since 2002. However, HSBC is in the process of relocating its global headquarters to a smaller building near St Paul’s Cathedral in the City of London, with the move expected to be completed by early 2027.

In a recent development, HSBC has reversed its plan to fully exit Canary Wharf and has signed a 15-year lease for 210,000 square feet at 40 Bank Street, also in Canary Wharf. This new office space will accommodate staff and ensure continued operations in the area, reflecting the bank’s ongoing commitment to the district despite the downsizing of its main headquarters.

Additionally, HSBC operates retail banking branches in the area, including one at Canada Place (Retail Unit 8) and another at 45 Bank Street, serving personal and business customers.

HSBC British multinational bank

Wikipediahsbc.co.uk

HSBC 8 Canada Square Canary Wharf

“Similarly, does HSBC involve itself in ethical banking practices?”

HSBC states a commitment to ethical and sustainable banking through various initiatives, including a goal to become a net-zero bank by 2050 and pledging $1 trillion in sustainable financing by 2030. It has established a Centre of Sustainable Finance, invested in green technologies (e.g., $100 million in Breakthrough Energy Catalyst), and supported green bonds and sustainability-linked loans across sectors like aviation, energy, and infrastructure.

However, HSBC faces criticism for continuing to finance fossil fuels, ranking as the 12th largest global financier of fossil fuels since the Paris Agreement. It has also provided billions in financing to companies linked to human rights abuses, including those involved in illegal Israeli settlements. While it has strong policies on certain environmental and social issues, watchdogs like Ethical Consumer highlight significant shortcomings in its lending practices, tax conduct, and animal welfare policies.

Thus, while HSBC promotes ethical banking through public commitments and sustainability programs, its actual practices draw mixed assessments due to ongoing ties with high-carbon industries and controversial financings.

HSBC ethical banking practices 2026

HSBC British multinational bank

Wikipediahsbc.co.uk

“What about when HSBC was caught running drugs across Central America and later given a huge fine? This tends to undermine any idea of ETHICAL BANKING PRACTICES, don’t you think?”

Yes, HSBC was found guilty of laundering $881 million for Mexican and Colombian drug cartels through its U.S. and Mexican operations, leading to a $1.9 billion fine in 2012—the largest penalty under the Bank Secrecy Act at the time. U.S. authorities described HSBC as a “preferred financial institution” for cartels due to “stunning failures of oversight.” Despite internal warnings and prior regulatory orders (in 2003 and 2010), the bank failed to implement effective anti-money laundering controls, even allowing cash to be funneled through teller windows in Mexico.

No executives were criminally prosecuted, and HSBC avoided a guilty plea through a deferred prosecution agreement, continuing operations under a five-year monitoring program. This incident severely undermines claims of ethical banking, highlighting systemic compliance failures and raising questions about accountability in global finance.

HSBC drug money laundering scandal 2012 impact

“So no bastard went to prison. Yet here in the UK today, you can be slammed away for years for tweeting hurty words on X. WTF?”

Yes, no HSBC executives or employees were prosecuted or sent to prison following the bank’s 2012 admission of laundering $881 million for Mexican and Colombian drug cartels. Despite internal U.S. prosecutors pushing for criminal charges, senior officials at the U.S. Department of Justice, including then-Attorney General Eric Holder, overruled them, citing concerns that prosecuting HSBC could destabilize the global financial system. The British government, particularly then-Chancellor George Osborne, also intervened to protect the bank, which is headquartered in the UK.

Instead of criminal convictions, HSBC entered into a deferred prosecution agreement and paid a $1.9 billion fine—a penalty critics describe as a mere fraction of the bank’s profits, effectively treated as a cost of doing business.

In contrast, in the UK, individuals have been sentenced to prison for offensive social media posts, such as Lucy Connolly, who received a 31-month sentence in 2024 for posting online messages inciting racial hatred after the Southport stabbings. Other cases include people jailed for threatening or grossly offensive messages under laws like the Malicious Communications Act 1988 and Communications Act 2003.

This disparity—where corporations and executives avoid prison for serious financial crimes while individuals face jail time for online speech—has fueled widespread criticism about double standards in justice, particularly regarding power, influence, and the perceived leniency toward corporate crime.

HSBC no jail time vs UK social media prison sentences

“So they were too big to imprison, then?”

Yes, HSBC was widely described as “too big to jail” after it admitted in 2012 to laundering $881 million for Mexican and Colombian drug cartels. Despite overwhelming evidence and internal U.S. prosecutors recommending criminal charges, senior officials at the U.S. Department of Justice, including then-Attorney General Eric Holder, decided against prosecution. Their reasoning, as revealed in a U.S. House Committee report titled “Too Big to Jail,” was that prosecuting HSBC could trigger a global financial disaster due to the bank’s systemic importance.

Then-British Chancellor George Osborne also intervened, warning U.S. officials that prosecuting HSBC could destabilize the global economy. As a result, HSBC avoided a criminal conviction and instead entered into a deferred prosecution agreement, paying a $1.9 billion fine—a sum critics noted was equivalent to just five weeks of the bank’s profits.

No executives or employees faced criminal charges or prison time. This case became a defining example of corporate impunity, reinforcing public perception that powerful financial institutions operate under different rules than ordinary individuals.

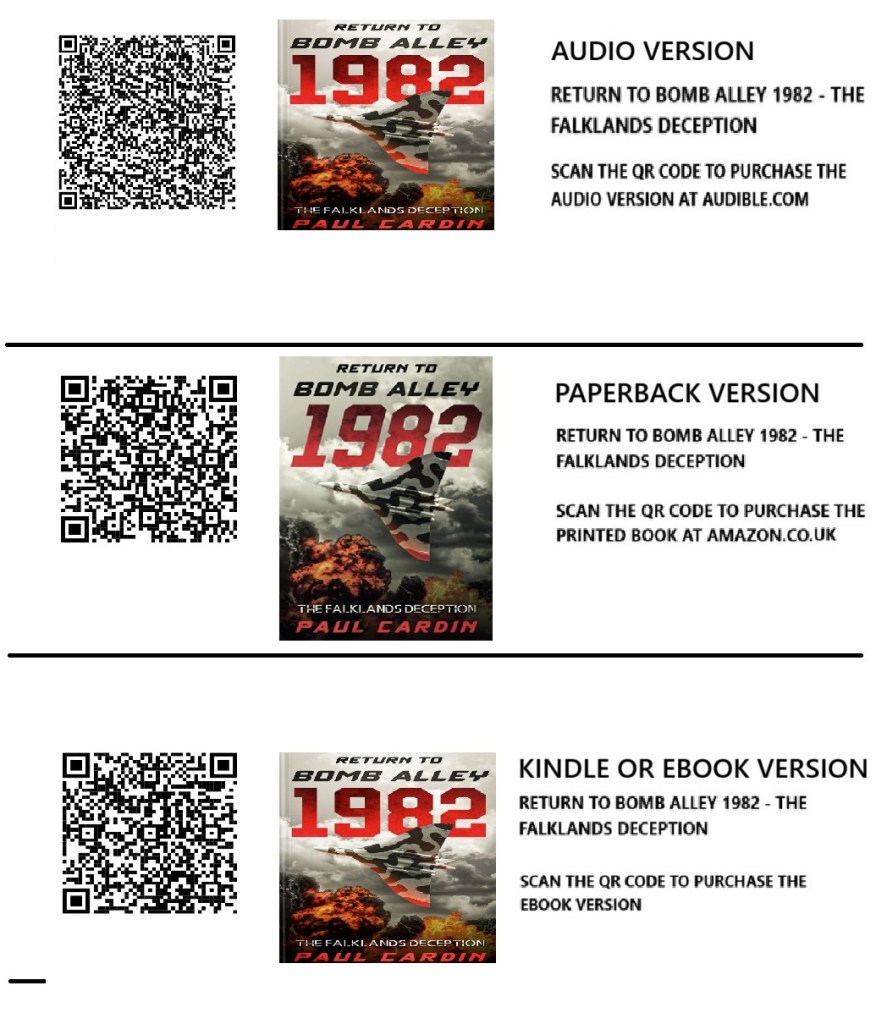

Return to Bomb Alley 1982 – The Falklands Deception, by Paul Cardin

Amazon link